Chris Speicher, Speicher Group at RE/MAX Realty Centre

In terms of the profitability of the company, ROI is the only thing that matters. It’s not about how much you spend, it’s about how much you make from that spend.

That’s the first thing that Chris Speicher told me when we chatted about how he evaluates his return on investment.

Chris is a co-founder of The Speicher Group with RE/MAX Realty Centre in Olney, Maryland. Chris and his wife Peggy Lyn, both Zillow Premier Agents®, run a top-producing team in the D.C. area and often share their business practices with agents throughout the country at BoomTown, RE/MAX and Tom Ferry events.

What is ROI?

ROI - return on investment - is a measure of the effectiveness of an investment, such as a marketing or advertising expense. In other words, it’s a way to determine where you are getting the most “bang for your buck.”

As entrepreneurs and business owners, which all real estate agents are, it is important for you to know where you are spending your marketing, branding and advertising dollars - and to track what kind of return that investment is generating.

Calculating ROI

Calculating ROI doesn’t require any complex math or experience in solving differential equations. The formula is quite simple:

return on investment = (gain from investment – cost of investment) / cost of investment

Let’s look at an example:

Say you spend $500 per month on Zillow advertising. You track how your advertising performs - you do track this, don’t you? - and find out that last year your closings from Zillow-generated contacts resulted in $35,000 in commissions.

Your cost of investment in the above formula would be equal to $500/month x 12 months, or $6000. Your gain from investment would be the commissions earned for the year, or $35,000.

Plugging that into the above formula gets us this:

return on investment = (35,000 – 6,000) / 6,000 = 29,000 / 6,000 = 4.84

To put that number into context, you made $4.83 for every $1.00 you spent on Zillow advertising.

ROI can also be calculated as a percentage:

return on investment (%) = (net profit / investment) × 100

Or, using the numbers in our example, (29,000 / 6000) × 100 = 483%. Anything above 100% means that you are making more money than you spend - and that’s what you want to see!

What is a “good” ROI?

This is a question you need to evaluate based on your business model, expenses and expectations. ROI is a great tool for comparing similar activities.

Imagine that in addition to advertising on Zillow, you also have your own website and advertise in the newspaper and on Joe’s Generic Real Estate Listing Website. You calculate the ROI for each of these expenses (investments) separately and come up with this:

Zillow ROI = 4.83

Website ROI = 3.50

Newspaper ROI = 1.25

Joe’s Generic Listing Site = 0.5

(Note: these ROI numbers are completely made up, though I’ve talked to many Zillow Premier agents with ROIs of 4, 5 and even 10.)

This ROI comparison shows you that you are making a very positive return on your Zillow advertising and website, a marginal return on your newspaper ad, and you are losing money on Joe’s Generic Listing Site.

Now that you’re armed with this data, what do you do about it?

You are making 50 cents for every dollar you spend on Joe’s Generic Site. Spending more than you bring in is a path to bankruptcy, so break up with Joe and instead invest that money in your high-ROI activities.

What about the newspaper? Yes, you are making money: 25 cents for every dollar spent. But the low-return newspaper ads don’t approach the $3.50 – $4.83 return per dollar spent from your website or Zillow. So, why not dump everything but the highest-ROI activity?

Diversification. Don’t put all your eggs in one basket. You want multiple streams of income and business, so focusing on the top two or three ROI activities makes sense.

What about cost per lead?

I asked Chris for his thoughts on the cost per lead (CPL) metric. You know the one - you’ve probably heard someone say, “My cost per lead is only four bucks using this system! Those other guys have a CPL of $30!”

Presented with this example, Chris’ response was, “So? What’s the ROI for those two lead sources? If it takes ten of those four dollar leads, costing you $40, to get a client but only one of the $30 leads, then the $30 lead generates a higher ROI and puts more money in your pocket. Remember, it’s not about what you spend, it’s about what you make.”

“Conversion is insanely important,” Chris told me. “That’s the one thing the agent has complete control over. If I’m converting at 2 percent and making a 500 percent ROI, doubling my conversion rate to 4 percent doubles my ROI to 1000 percent. It’s simple math. I don’t really care about the CPL, I care about the ROI.”

Chris and I shared stories and agreed that many of the agents we talk to don’t know their ROI for any particular investment. ROI is a fundamental measure of the health of your business and is a great tool for evaluating recurring expenses. Track it, make adjustments, measure it again, rinse and repeat.

“If you don’t know where you are spending your money, and what the return on that investment is, you’re not really running a business, you’re just guessing,” said Chris.

Wise words from an experienced agent. Thanks for the talk, Chris!

Zillow’s ROI Calculator

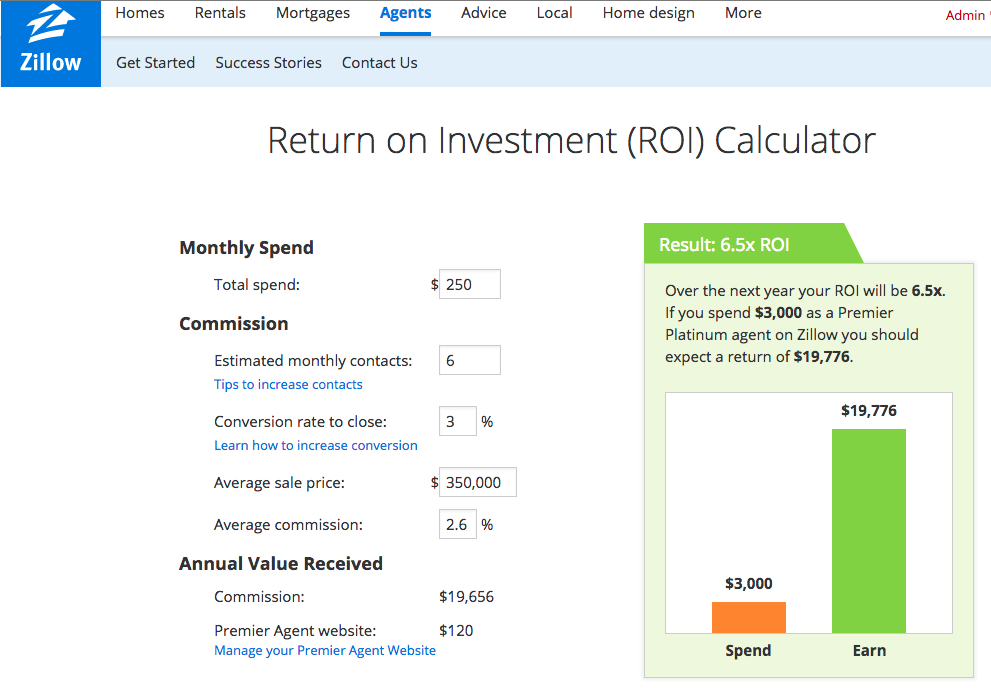

Log in to your free Zillow account to use Zillow’s ROI calculator. It provides a clear picture of your ROI and allows you to adjust your entries to see how that impacts your final numbers.

Zillow’s ROI calculator